Why 'Passive' Investing Is Winning: 4 ETF Facts You Need to Know

- Oct 16, 2025

- 3 min read

Introduction: The Investing Maze

Investors once faced a stark choice: the targeted bet of a single stock or the broad diversification of a mutual fund. Today, a powerful third option—the Exchange Traded Fund (ETF)—has emerged, offering access not just to stock indices like the NIFTY 50, but to diverse asset classes like bonds, gold, and more. Yet, beyond this flexibility lie several counter-intuitive advantages that are fundamentally changing the game for savvy investors. This post will reveal the most impactful and surprising takeaways about ETFs, based on recent data.

1. Takeaway #1: The Shocking Difference in Cost

They Can Be Dramatically Cheaper Than You Think

All investment funds charge an annual fee known as an "expense ratio" to cover their operating costs. While this fee might seem small, the difference between fund types can be substantial, directly impacting your long-term returns.

The data reveals a stark contrast: the average expense ratio for 17 NIFTY 50 ETFs is just 0.08%, while the average for 28 regular large-cap active mutual funds is 2.2%.

This massive cost difference is critical for long-term wealth creation. A lower expense ratio means that more of your money remains invested, allowing it to compound more effectively over time. Year after year, these seemingly small savings can add up to a significant amount, giving your portfolio a powerful advantage.

2. Takeaway #2: When "Passive" Actively Outperforms

The Counter-Intuitive Truth: "Passive" Is Beating "Active"

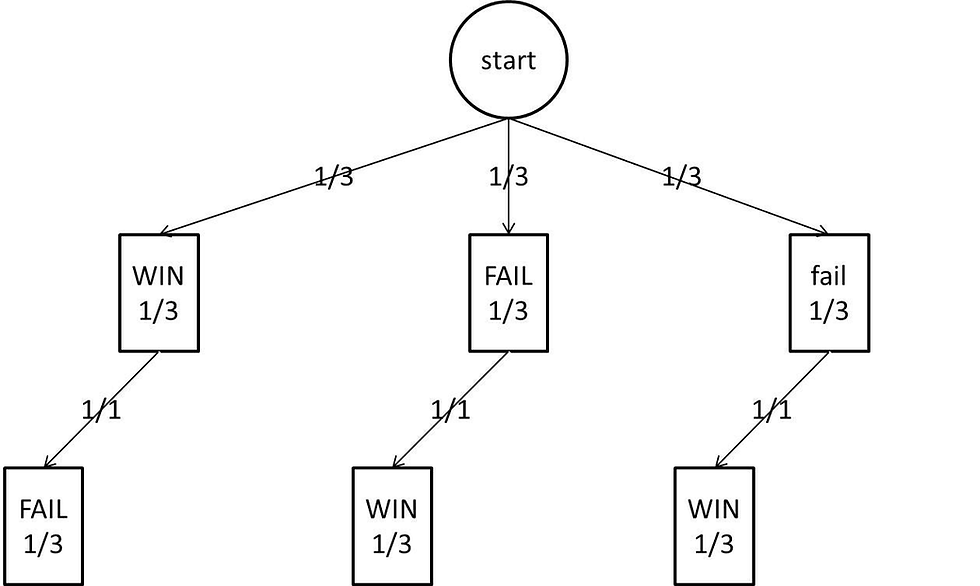

Active mutual funds are managed by professionals who aim to outperform the market benchmark through strategic stock selection. In contrast, passive ETFs don't try to beat the market; their objective is to simply mirror the performance of a specific index, like the NIFTY 50. This is happening against a backdrop where large-cap funds are finding it increasingly difficult to outperform benchmark indices, making the passive approach surprisingly effective.

The result is that a majority of active funds are failing to outperform their passive counterparts. Despite the goal of active management and the higher fees they command, passive ETFs have demonstrated superior performance.

NIFTY 50 ETFs have outperformed 71% and 85% of large cap mutual funds in the previous 1 year and 3 year period respectively (as on Dec 31, 2019).

Source: ACE MF

To put this in perspective, over the previous 3-year period, NIFTY 50 ETFs outperformed their large-cap mutual fund counterparts by an average of 2.7%.

3. Takeaway #3: The Flexibility of a Stock, The Power of a Fund

They Trade Like a Stock, All Day Long

A traditional open-ended mutual fund has a significant limitation: you can only buy or sell shares once per day, at the final Net Asset Value (NAV) calculated after the market closes. This means you have no control over the exact price you get.

ETFs, as their name implies, are listed and traded on stock exchanges throughout the day, just like individual stocks. This provides a level of flexibility that mutual funds lack.

The price of an ETF tracks an "indicative NAV" (iNAV) in real-time. This means if the NIFTY 50 index rises 1% by mid-morning, the price of a NIFTY 50 ETF will instantly reflect that 1% gain, allowing you to trade on that new price immediately. This allows investors to react to market movements as they happen, a feature not available with traditional mutual funds.

4. Takeaway #4: You Know Exactly What You Own, Every Day

Radical Transparency in Your Portfolio

ETFs offer a high degree of transparency because they are designed to replicate a public index, meaning their underlying portfolio of securities is disclosed on a daily basis.

This stands in sharp contrast to active mutual funds, whose portfolios are created based on a fund manager’s proprietary views and strategies. Because this strategy is the source of their potential "edge," the full holdings are not disclosed daily. With an ETF, this uncertainty is eliminated, giving investors the confidence of knowing precisely what assets they hold at any given time.

Conclusion: A Smarter Way to Invest?

These four takeaways paint a clear picture of the modern ETF: an investment vehicle that offers incredibly low costs, a track record of outperforming the majority of its more expensive active counterparts, the trading flexibility of a stock, and complete daily transparency.

Comments