Inside the Machine: 5 Surprising Truths About the World's $7.5 Trillion Currency Market

- Oct 18, 2025

- 5 min read

Updated: Nov 1, 2025

Introduction: The World's Biggest Financial Market is Not What You Think

The foreign exchange (FX) market is the largest financial market in the world, a colossal ecosystem where an average of $7.5 trillion changed hands every single day in April 2022. The US dollar is at the heart of this activity, appearing on one side of almost 90% of all global transactions.

But behind these staggering numbers lies a hidden complexity. The market's internal mechanics are far from simple, a reality captured perfectly by an executive at a major FX liquidity provider:

"Foreign exchange spot is the simplest asset class one can trade, yet it has the most complex trading environment."

This post will peel back the curtain to reveal five surprising realities about how this critical global market actually functions.

1. The Biggest Market Runs on the Fewest Rules

It's a striking paradox: the world's largest financial market is subject to "notably less regulatory oversight than equity and bond markets in most countries." Unlike other major markets shaped by top-down regulation, the structure of the FX market has "mostly evolved endogenously," driven by the commercial interests and needs of its participants.

The market's answer to this regulatory gap is the "FX Global Code." This isn't a book of hard laws but a "soft" approach to governance. Developed by a broad group of central banks and market participants, the Code establishes a set of principles for "good practice" in areas like ethics, execution, and risk management. Participants signal their adherence by signing a public "statement of commitment."

While this reliance on principles may seem toothless, this soft approach has demonstrated the power to change behavior at the millisecond level. For instance, the Code’s 2021 guidance against using "additional hold time" in last look practices—a controversial tactic where liquidity providers would delay a trade to see if the price moved in their favor—had a "rapid and substantial impact." In response, numerous large dealers publicly announced an end to the practice, proving that in this market, shared principles can be as powerful as rigid rules.

2. It’s Not About Imports and Exports Anymore

A common assumption is that the FX market exists primarily to help companies buy and sell goods across borders. While that remains a function, it is no longer the market's primary driver. Today, FX trading for financial motives, such as investments in foreign securities, "far exceeds the transaction volume related to international trade."

Data from the past 20 years illustrates this fundamental shift:

Non-Financial Customers (e.g., corporations trading goods): Their share of total trading has declined from about 20% to less than 10%.

Financial Customers (e.g., investors, funds): Their share has grown to more than 50%.

This transformation means the FX market is now as much an asset class in its own right—a place for speculation and investment—as it is a simple mechanism for global commerce.

3. The Rise of the Machines is Complete

The days of traders shouting orders over the phone are largely over. The FX market has evolved from a "two-tier structure" of voice and telex trading into a fragmented, high-speed electronic arena. In this new environment, a new set of players has emerged: principal trading firms (PTFs), often referred to as high-frequency traders. These tech-driven firms have "challenged the banks" and now act as major liquidity providers.

The takeover by algorithms has been swift and total. Data from the EBS Market platform, a key trading venue, shows that by 2022:

Manual Trading: Has declined to only about 15% of trading volume.

Algorithmic "API Trading": Now accounts for over 80% of activity.

These algorithms don't just execute human decisions more efficiently; many are programmed to automate the decision to trade itself, constantly scanning the market for fleeting profit opportunities. The technological arms race became so intense that some trading venues introduced "speed bumps"—such as randomized pauses or "latency floors" of a few milliseconds—specifically to protect slower participants from the most aggressive predatory algorithms, illustrating a constant cat-and-mouse game at the heart of the market.

4. The Heart of the Market is Shrinking

Historically, the entire FX market revolved around two central platforms that formed the "primary market": EBS Market and Refinitiv Matching. These were the main sources of price discovery, where the "true" price of a currency pair was established.

But in a counter-intuitive twist, even as the overall FX market has grown massively, trading volume on these primary platforms has "declined substantially since the Global Financial Crisis." However, this doesn't mean price discovery has become rudderless. In a crucial parallel development, trading in exchange-traded currency futures, particularly on the Chicago Mercantile Exchange (CME), has surged. In fact, volume in currency futures now often exceeds the spot trading volume on the traditional primary market.

A new duality has emerged. Many market participants, especially the newer principal trading firms, now look to the futures market as a primary reference for pricing and hedging. Yet, the old primary venues remain a "key locus of price discovery." During periods of market turmoil, trading activity often flows back to these core platforms, reaffirming their foundational, if diminished, role in a market whose center of gravity is clearly shifting.

5. The "Liquidity Mirage": Seeing a Price Doesn’t Mean You'll Get It

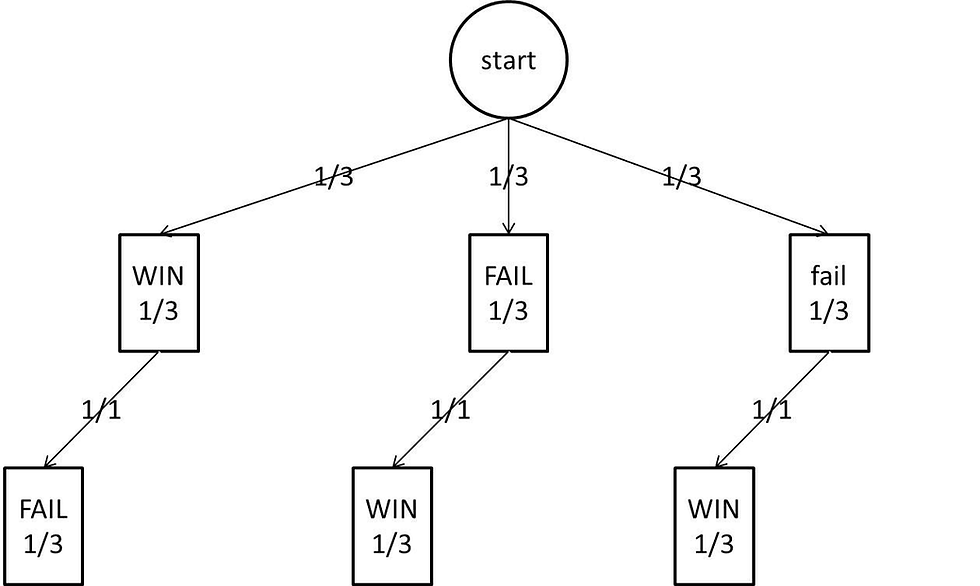

In the ultra-fast world of electronic FX, a practice known as "last look" has become widespread. In simple terms, last look is a process where a liquidity provider's computer takes a final, millisecond-long look at a trade request before deciding whether to accept or reject it, even after posting an apparently available price.

This creates a critical trade-off. On one hand, last look allows providers to offer tighter (better) bid-ask spreads because it protects them from certain risks. On the other hand, it means the liquidity you see on the screen is not "firm," and your request to trade at that price might be rejected.

This practice of "last look" is what enables the "liquidity mirage," an illusion of market depth. Because providers know they can use their final look to reject some trades, they can post the same pool of liquidity across many different venues at once. This makes the total available market depth appear much larger than it truly is. As a result, traders must constantly balance the quest for the best price against the certainty of execution in a market now composed of a complex mix of "firm" and "non-firm" liquidity.

Conclusion: A Millisecond Market

The foreign exchange market has transformed. What was once a relationship-driven market of phone calls and telexes is now a highly complex, fragmented, and algorithm-driven ecosystem that operates at near-light speed. The five realities above reveal a system far more intricate than most imagine.

As technology continues to reshape this global giant, a critical question remains: will it become more efficient and stable, or are we building a system so complex that its next crisis is just a few milliseconds away?

Comments